Ecommerce for Luxury Watches – Digital vs Analogue?

All articlesHow do you bring analogue timepieces to digital platforms? With more retailers than ever setting up ecommerce sites, luxury watch makers have faced a challenge. How can the luxury watch market adapt to the pressure to provide an online store? We’ll take a look at how some retailers have used ecommerce for luxury watches.

A global struggle for luxury watches

Luxury watches have traditionally been slow to adopt new channels or strategies, especially when it comes to online presence. Being objects of timelessness, the physical experiences when shopping in-store are key in customer considerations before purchasing. But with storefronts closed globally during the pandemic, watch retailers had to reconsider how they would reach customers.

Some watch retailers suffered through the pandemic; the Federation of the Swiss Watch Industry reported that watch exports globally dropped by 21.8%. This is somewhat unsurprising considering stores were closed for 42% of potential trading hours (Watches of Switzerland Group PLC, 2021). However, companies that had a pre-existing ecommerce platform did considerably better during the pandemic. Watches of Switzerland, a long-standing British retailer, found their ecommerce sales increase by 120.5%, with their overall sales increasing over the 2020/2021 financial year by 3.6%. Having invested previously on their ecommerce and digital marketing strategy, they thrived through a tough time for global retail.

China’s luxury ecommerce market

While watch brands have typically stayed away from online channels, the Chinese market may change perceptions. Brands including Cartier, Piaget, Swatch Group, and LVMH have moved onto Tmall or JD, with other brands following suit. China has been growing into the biggest market for luxury goods and, unlike the western market keeping sales exclusive to brick-and-mortar stores, have utilised the digital market to its fullest.

Tmall and JD are two online retailers that dominate much of the online market in China, with each respectively having luxury departments. Part of the move to digital is due to the younger market; a third of their online luxury buyers are born after 1990. There’s an added level of exclusivity with Tmall’s Luxury Pavilion, an invite only area with perks and exclusive events for members. This means for high-luxury brands, who’ve already implemented exclusivity into their brick-and-mortar strategy, going online doesn’t mean being accessible to all markets.

Creating real emotions in a digital space

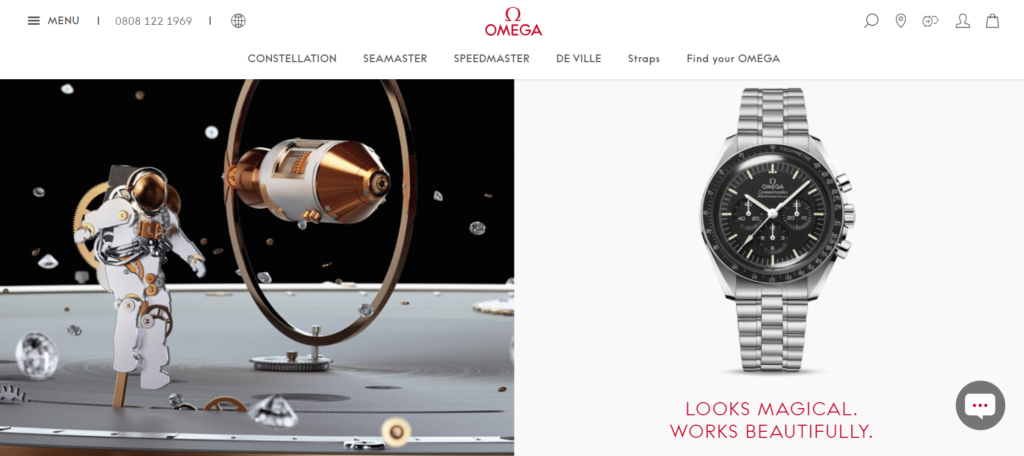

Omega’s Ecommerce Website, from https://www.omegawatches.com/en-gb/

One concern for luxury watch brands is that ecommerce sites may not deliver the same experience as physical shops. While this can be true, ecommerce sites are becoming more advanced in their digital offerings. Developers are creating more methods for an immersive shopping experience. For example, some brands are now adopting AR into their websites, so users can see how products would look on themselves digitally. 3D rendering, sound and animation also add to the online experience. There have already been examples of successful online-exclusive sales. According to WatchTime, Omega’s ‘Speedy Tuesday’ Ultraman release in 2018 sold 2,012 watches in just 1 hour and 53 minutes. This isn’t a new phenomenon either; for many years people have pre-ordered watches that they had only briefly seen in promotions or at shows.

However, some aspects of physical shopping can’t be replaced entirely by online channels. In-person customer assistance, real-life networking events, as well as being able to feel the weight and fit of a watch all have a big impact on the buying experience. But research suggests that ecommerce doesn’t have to mean the final purchase has to be digital. The 2019 China Luxury Digital Playbook suggests that 82% of luxury purchases are a result of ROPO – research online, purchase offline. This means that even if the final decision is made in a physical store, having an effective ecommerce site is essential to the browsing and buying experience.

Digital design for analogue timepieces

The biggest takeaway from all of this is that having an ecommerce site doesn’t mean a reduction in exclusivity or luxury experiences. Instead, the need for brands in this market to have a connected range of touchpoints in both physical and digital spaces is becomingly increasingly more important. Utilising ecommerce for luxury watches means that customers have more choice for both how to browse and where to buy. And, as technology improves, people are finding more ways to bring the luxury experience from in-store to digital spaces.

Want to learn how we can help with your ecommerce strategy? Click here.

Sources

Boston Consulting Group; Tencent, 2019. China Luxury. [Online]

Available at: http://media-publications.bcg.com/france/2019BCGTencent_Luxury_Digital_Playbook.pdf

Federation of the Swiss Watch Industry, 2020. World distribution of Swiss watch exports. [Online]

Available at: https://www.fhs.swiss/eng/statistics.html

Staff Report, 2018. Omega’s New Speedy Tuesday Ultraman Sells Out in an Hour. [Online]

Available at: https://watchtime.me/news/article/1124/omega-s-new-speedy-tuesday-ultraman-sells-out-in-an-hour

Watches of Switzerland Group PLC, 2021. Q4 FY21 Trading. [Online]

Available at: https://www.thewosgroupplc.com/investors/results-centre/